IEA (2021), The Role of Critical Minerals in Clean Energy Transitions, IEA, Paris https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions, Licence: CC BY 4.0

Reliable supply of minerals

Policy makers have a crucial role in determining whether critical minerals are a vital enabler for clean energy transitions or a bottleneck in the process

A huge rise in demand for critical minerals raises questions about whether this growth – in most cases well above the historical pace – can be supplied in a reliable manner, and whether the environmental and social consequences associated with mineral production can be managed properly. The price rallies in the latter part of 2020 and early 2021 may have provided a preview of what could happen when the world accelerates onto a decarbonisation pathway. If history is any guide, the market responds to strains on supply by reducing demand, substitution or increasing supply. But this is typically accompanied by price volatility, considerable time lags or some loss of performance or efficiency. In the context of clean energy transitions, inadequate mineral supply could result in more expensive, delayed or less efficient transitions. Given the urgency of reducing emissions, this is a possibility that the world can ill afford.

Today’s supply and investment plans are not yet ready for accelerated energy transitions

Prices for certain minerals have risen strongly since the second half of 2020, with some reaching multi-year highs. This was due to expectations of strong future growth, as well as demand recovery in China. While it is too early to brace for the next price cycle, if we slightly extend the time horizon, there are ample reasons to be vigilant about the ability of supply to meet demand – especially as many governments redouble efforts to accelerate energy transitions.

In the Sustainable Development Scenario (SDS), the scale of demand growth is well above the levels seen in recent decades. For example, in the period to 2040 annual average demand growth for nickel and cobalt is two and five times higher respectively than the levels seen in the 2010s. In the case of copper, the SDS sees a continuation of strong demand growth in the 2010s through the coming decades.

The picture for near-term supply is mixed. Some minerals such as lithium raw material are expected to be in surplus in the near term, while others such as battery-grade nickel or certain rare earth elements (REEs) (e.g. neodymium and dysprosium) might face tight supply in the years ahead. However, after the medium term, projected demand surpasses the expected supply from existing mines and projects under construction for most minerals, meaning that significant additional investment will be needed to support demand growth.

Committed mine production and primary demand for cobalt, 2020-2040

OpenCurrent supply and investment plans are broadly geared to a world of more gradual, insufficient action on climate change (the Stated Policies Scenario [STEPS] trajectory), but not sufficient to support accelerated energy transitions. While there are a host of projects in the pipeline at varying stages of development, several risk factors may, if unchecked, increase the possibility of market tightness and new price cycles.

The geographical concentration of production is unlikely to change in the near term

Today’s production and processing operations for many energy transition minerals are highly concentrated in a small number of countries, making the system vulnerable to political instability, geopolitical risks and possible export restrictions.

Our analysis of today’s project pipeline indicates that this picture is unlikely to change in the near term. With the exception of copper, most of the output growth for lithium, nickel and cobalt are expected to come from today’s major producers, implying a higher degree of concentration in the years ahead. Under these circumstances, physical disruptions or regulatory and geopolitical events in major producing countries can have large impacts on the availability of minerals, and in turn on prices. Recent events, such as Indonesia’s ban on nickel ore export and China’s export ban on REEs, serve to highlight these concerns. More recently, the military coup in Myanmar has raised concerns over supply disruption of heavy REEs, fuelling a surge in prices. Natural disasters have also become one of the most frequent causes of mineral supply disruption, third only to accidents and labour strikes (Hatayama and Tahara, 2018).

Long project lead times exacerbate the risk of a mismatch in timing between demand and the industry’s ability to bring on new projects

Analysis of major mines that came online between 2010 and 2019 shows that it took on average over 16 years to develop projects from discovery to first production, although the exact duration varies by mineral, location and mine type. It took more than 12 years to complete exploration and feasibility studies, and 4-5 years for the construction phase. These long lead times raise questions about the ability of supply to ramp up output if demand were to pick up rapidly. If companies wait for deficits to emerge before commiting to new projects, this could lead to a prolonged period of market tightness and price volatility. A further complication is that mining is only one part of the value chain. Whether investment occurs in a co-ordinated manner throughout the value chain is another significant issue, as price signals may not be passed efficiently along the chain.

Declining ore quality poses multiple challenges for extraction and processing costs, emissions and waste volumes

There are generally no signs of shortages in the amount of available resources: despite continued production growth over the past decades, economically viable reserves have been increasing for many energy transition minerals. For example, lithium reserves increased by 40% between 2011 and 2019, while production expanded almost three times. The volume of copper reserves also rose by 30% in the last 10 years. This is because reserves have been replenished by exploration activities triggered by growing demand.

Concerns about resources relate to quality rather than quantity. In recent years, ore quality has continued to decline across commodities as high-quality deposits (and higher-grade parts of the deposits) are exploited earlier. Technological improvement that allows the exploitation of lower-grade deposits has also played a role. For example, the average copper ore grade in Chile has decreased by 30% over the last 15 years. This brings about multiple challenges. Extracting metal content from lower-grade ores requires more energy, exerting upward pressure on extraction and processing costs and CO2 emissions. Lower-grade ores also generate larger amounts of rock waste and tailings that require careful treatment. Strengthened efforts would be needed to offset upward pressures on production costs.

Growing imperative to improve environmental performance could put upward pressure on production costs of energy-intensive mining and processing operations

While minerals play a vital role in supporting clean energy transitions, energy is also crucial in the production of minerals. Due in part to declining resource quality, the production and processing of energy transition minerals are energy-intensive, involving higher emissions to produce the same quantity of product. In recent years, mining and processing companies have faced growing pressure to address these and other issues related to their social and environmental performance. A growing number of consumers and investors are requesting companies to disclose targets and action plans on these issues. Tightening scrutiny of ESG issues could have an impact on costs and supply prospects.

Mining assets are exposed to growing climate risks and water stress

A combination of more frequent drought events in major producing regions and higher water intensity in ore processing has brought the critical importance of sustainable water sourcing to attention. For example, in 2019 the worst drought in more than 60 years severely affected some operations in Chile, with similar events having occurred in Australia, Zambia and others. The El Teniente mine, the largest underground copper mine in Chile, implemented water rationing to deal with severe droughts (CRU, 2020).

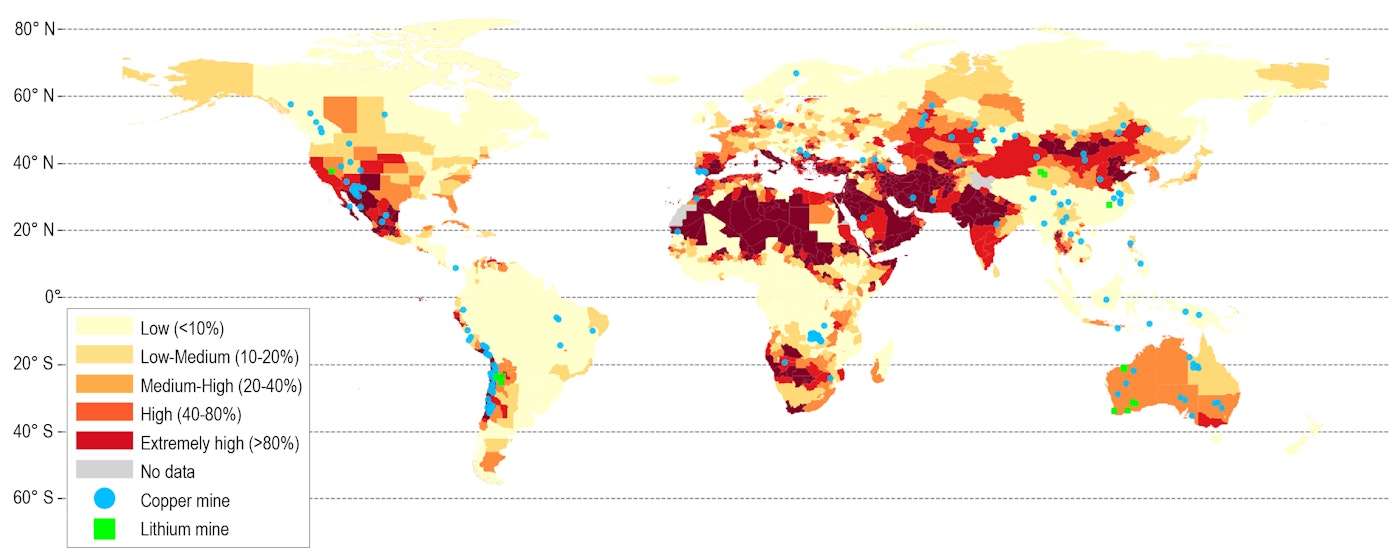

Among minerals, copper and lithium are particularly vulnerable to water stress given their high water requirements. Over 50% of today’s lithium production is concentrated in areas with high water stress levels. Some 80% of copper output in Chile is produced in mines located in high water stress and arid areas. This has triggered companies to invest in desalination capacity to mitigate the risk. As climate change causes more frequent droughts and alters water flows, the availability of high-quality water resources will become a crucial factor affecting stable minerals supplies.

In addition to water shortage, several major producing regions such as Australia, China, and Africa are also subject to other forms of climate risk, including extreme heat or flooding, which pose challenges to ensuring reliable and sustainable supplies. For example, flooding can lead to spills of hazardous waste from mine sites or waste storage, and tailings dam failure, with extensive environmental damage (Rüttinger et al., 2020). This requires companies to assess physical risks from climate change in their operations and integrate climate resilience planning in their sustainability strategies.

Location of copper and lithium mines and water stress levels, 2020

Open

Supply prospects for the focus minerals

Each mineral faces a different set of challenges in ensuring adequate supply

Key challenges around supply of selected minerals

|

Mineral |

Key challenges |

|---|---|

|

Copper |

|

|

Lithium |

|

|

Nickel |

|

|

Cobalt |

|

|

Rare earth elements |

|

HPAL = high-pressure acid leaching; NPI = nickel pig iron.

Copper

New projects under development could bring a boost to near-term supply, but more is needed to support rising demand

Thanks to its unmatched thermal and electrical conductivity, copper is widely used in a broad range of electronic and industrial applications. Its attributes make it challenging to substitute. The western part of South America, notably Chile and Peru, is the largest producer of mined copper, responsible for 40% of global output. China, the DRC, the United States and Australia are the other major producing countries. China is the largest copper refining country, with around 40% market share, followed by Chile, Japan and Russia. However, as China accounts for 50% of global demand for refined copper, it also imports refined copper products from abroad.

Copper supply has been expanding rapidly over the past decades to satisfy rising demand caused by strong economic growth in emerging and developing economies. However, past trends may not be a good guide to what could happen in the coming decades. Production at today’s major copper mines has already peaked or is expected to peak in the early 2020s due to declining ore quality and reserve exhaustion. For example, the world’s largest copper mine, Escondida in Chile, appears to have reached a peak and its production in 2025 is expected to be at least 5% lower than today.

On the back of optimism for copper’s role in the energy transition, investment has been picking up. A few large projects, such as Quellaveco in Peru and Kamoa-Kakula in the DRC are under construction. Several expansion projects such as Oyu Tolgoi in Mongolia are also in progress. These projects could deliver considerable near-term supply, if completed on schedule. However, beyond the near term, few projects are planned to start operations in the late 2020s, while output from exsting mines is expected to contract further. Meeting rising demand in the longer term would require continued new project development.

Declining ore quality exerts upward pressure on production costs and emissions, requiring additional efforts for technology innovation and efficiency improvement. There are also environmental challenges. Major copper producing areas in South America face water scarcity. Moreover, hazardous elements such as arsenic are highly concerned in the copper industry. The average arsenic content in Chilean concentrate has doubled since the beginning of 2000s, leading to higher costs to manage wastewater and mine tailings.

Lithium

The fastest-growing mineral, driven by surging EV deployment. The supply of lithium chemicals in the spotlight

Lithium demand for clean energy technologies is growing at the fastest pace among major minerals. While other minerals used in EVs (e.g. cobalt, nickel) are subject to uncertainty around different chemistry choices, lithium demand is relatively immune to these risks, with additional upsides if all-solid-state batteries are widely adopted. Clean energy technologies represent around 30% of total lithium demand today (up from a minuscule share in 2010), and the rapid uptake of EV deployment raises the share to some 75% in the STEPS and over 90% in the SDS by 2040. While lithium carbonate is currently the main chemical product used in EVs, lithium hydroxide is expected to take its place as it is more suitable for battery cathodes with high nickel content.

Lithium is supplied from two very different types of resource (brine and spodumene): Chile and Australia are the main producers of them respectively. The price surge between 2015 and 2017 triggered a wave of investment in supply in Australia and other regions, which resulted in the plunge in prices in the late-2010s. The production expansion is set to continue until the mid-2020s, with major producers planning to expand their capacity through to the medium term. Both the largest mine and brine production site, Greenbushes in Australia and Salar de Atacama in Chile, are expanding their production capacity by more than 2.5 times. Whether these supplies are sufficient to support demand critically depends upon how demand evolves. Expected production volumes from existing mines and projects under construction look able to cover projected demand in the STEPS until the late 2020s, but they are not sufficient to support demand growth envisaged in the SDS.

New types of resources and technologies to recover lithium from unconventional resources may play an important role in the decade to come. For example, processing clay minerals is simpler and less energy-intensive than spodumene. Direct lithium extraction technologies are also on the horizon. Instead of evaporating all the water and chemically removing impurities, this process extracts the lithium directly from an unconcentrated brine to produce lithium chemicals without evaporation ponds (Grant, 2019). This holds the potential to reduce cost and lead times as brine accumulation takes more than a year and represents a major part of the capital expenditure of a brine project. New direct lithium extraction technologies could also help alleviate pressure around water sourcing.

Major strains are likely to come from the midstream value chain that converts raw materials into lithium chemicals. Only a handful of companies can produce high-quality, high-purity lithium chemical products, lithium hydroxide in particular: five major companies are responsible for three-quarters of global production capacity. While several planned expansion projects are in the pipeline, there is a question mark over how rapidly their capacity can come online to keep up with demand growth given that there are few deep-pocketed companies that can finance expansion projects, especially after several years of depressed prices. Looking ahead, the strains could be particularly great for lithium hydroxide, which is set to drive future demand growth (as it is favoured for high-nickel cathode chemistries).

A higher level of concentration is another challenge. Close to 60% of global lithium chemicals are produced in China (over 80% for lithium hydroxide). Chinese companies have also invested in companies in South America. For example, Tianqi Lithium, a large lithium chemical producer in China, acquired a minority stake (23.8%) in Chilean company SQM. Some projects to produce lithium hydroxide are being planned in Australia, the United States, the European Union and others, which could help diversify sources of supply, if successfully implemented.

Nickel

Quality challenge compounded by resource challenge, with Indonesia pivotal on both

Indonesia and the Philippines represent 45% of global nickel output today. Their domination of nickel production is set to intensify in the coming years. Indonesia alone accounts for around half of global production growth over the period to 2025. This suggests that future nickel supply is highly likely to be driven by progress in Indonesia, and global nickel supply chains may be affected significantly by physical events or policy change in Indonesia. On 1 January 2020 the government of Indonesia implemented a ban on nickel ore exports, two years ahead of the previously announced date, with the aim of processing its ore in domestic smelters and thereby nurturing a downstream industry. This in turn forced Chinese refiners to find new sources of ore supply from the Philippines or New Caledonia, but also to seek investment opportunities in Indonesia. Chinese companies invested and committed some USD 30 billion in the Indonesian nickel supply chain, with Tshingshan’s investments in the Morowali and Weda Bay industrial parks being the most prominent examples.

The prospects for nickel supply are mixed. The overall nickel market is likely to remain well supplied, but the picture becomes vastly different for battery-grade Class 1 products. In general, sulphide resources are a good fit for producing battery-grade Class 1 nickel. However, most of the production growth in the coming years is poised to come from the regions with vast amounts of laterite resources, such as Indonesia and the Philippines. As such, HPAL (high-pressure acid leaching) is gaining traction as a way to produce Class 1 products from laterite resources, with several projects being developed in Indonesia. However, HPAL projects have track records of large cost overruns and delays and require additional costs for acid production facilities. While projects in Indonesia can benefit from existing infrastructure, it remains to be seen if these projects come online as scheduled. There are also environmental issues that need to be addressed, such as higher CO2 emissions and tailings disposal.

While the prospects for HPAL projects in Indonesia are crucial, there are other pathways that could meet the demand for Class 1 products:

- Some of the current Class 1 consumption in the non-battery sector could be switched to Class 2, freeing up Class 1 nickel supply for batteries.

- Increasing stainless steel production from scrap materials would make some Class 1 supply available for other uses.

- Conventional oxide smelters, instead of HPAL, could produce Class 1 products from saprolite resources: Tsingshan, the world’s largest nickel producer, plans to convert nickel pig iron to nickel matte from its operations in Indonesia, which could then be further refined into Class 1 products (Roskill, 2021a). This is, however, highly energy-intensive and adds more cost.

- Given that Class 2 products are expected to be well supplied, it is conceivable to use Class 2 products such as ferronickel or nickel pig iron as feedstock to produce nickel sulfate for batteries. While technically possible, this process is likely to be cost-prohibitive.

- Recent movements towards high-nickel chemistries in battery cathode could be slowed if Class 1 nickel supply becomes tight and prices remain elevated, which could instead raise demand for cobalt.

While several options exist, all have drawbacks and would need higher prices for them to materialise. Given that there is no long list of projects in the pipeline outside Indonesia, progress in Indonesia will be key to future nickel supply for batteries, at least in the near term. Efforts to develop diversified supply sources would also be crucial to ensure reliable supplies in the longer term.

Cobalt

Efforts to formalise the ASM sector and promote enhanced recovery could reduce uncertainty around future supply

The development of cobalt demand is highly dependent on the direction in which battery cathode chemistries evolve. The composition of cathode chemistries is increasingly shifting towards those with high-nickel content, which could weigh on the appetite for cobalt. However, even under our default assumptions where this trend is sustained, the strong uptake of EVs underpins sevenfold growth in cobalt demand for clean energy technologies in the STEPS and over twenty-fold growth in the SDS over the period to 2040.

Some 70% of cobalt is produced in the DRC as a by-product of its copper mines. In the DRC, Glencore produced around 40% of the country’s production in 2019, followed by China Molybdenum. Some 10-20% of cobalt production in the DRC occurs in the form of artisanal and small-scale mining (ASM). The planned projects in the DRC account for the majority of the current project pipeline, implying that the DRC is set to remain the dominant source of cobalt supply for the time being. China processes around 70% of mined cobalt globally, followed by Finland, Belgium and Canada, and there is a close tie between the DRC and China. The supply chains for cobalt could therefore be highly affected by regional incidents on the trade route or policy changes in these countries.

The significant share of ASM production in the DRC is another challenge in cobalt supply. On the one hand, ASM production can have a stabilising effect on markets, as producers are sensitive to price changes and can reduce or ramp up production quickly. On the other hand, ASM may be more vulnerable to various economic and social events. While large-scale mining also has environmental and social impacts, ASM sites often present particular challenges due to their unregulated and informal nature, including unsafe conditions for workers and the presence of child labour.

Given these risks, there is a temptation for companies to disengage from the ASM supply chain. However, disengagement may paradoxically worsen the situation. ASM provides an important source of income for many local communities, which, with appropriate mitigation efforts, can help to address the root cause of child labour: poverty. In recognition of this, a growing number of companies are adopting due diligence practices aimed at identifying, assessing and mitigating these risks. The DRC government has announced support for formalising ASM through the state-owned Entreprise Générale du Cobalt, and some companies have established pilot projects to formalise the sector and prevent irresponsible practices.

Another complication is that cobalt is usually produced as a by-product of copper and nickel. It means that investment decisions for new project development are not necessarily linked to cobalt market dynamics, but rather more susceptible to the market conditions for copper and nickel, raising uncertainty about future supply. Efforts to adopt processing methods that maximise cobalt recovery can play an important role in mitigating risks.

Rare earth elements

A story of concentration and diversification. Demand soaring to new heights, imbalances looming

REEs are a family of 17 elements comprising 15 elements in the lanthanides group, plus scandium and yttrium. While each REE is used in different applications, four elements – neodymium, dysprosium, praseodymium and terbium – are of particular importance to the clean energy sector. Since the mid-1990s, China had emerged as a major producer. Its share of global production rose to over 95% in 2010, since when its share has fallen to just over 60% in 2019, as the United States, Myanmar and Australia started to boost production (USGS, 2021). However, separation and refining operations are still heavily concentrated in China, with almost 90% market share in 2019. There are currently four plants operating outside China. These plants, however, process only light REEs and the processing of heavy REEs is entirely dominated by China.

China’s attempt to limit REE exports in 2010 triggered many countries to consider options to reduce material intensity, find substitutes and diversify sources of production. Some 20 projects are under development in Australia, Canada and the United States, of which 5 projects plan to start operations in the early 2020s. Several processing plants are also under development, most notably in the United States.

While the surge in EV sales and renewables deployment presage a period of booming demand for the four REEs that are vital to clean energy technologies, it is not yet clear if supply can keep up with the demand trajectory as bottlenecks are hampering investment decisions. In addition to China’s position along the value chain, limited transparency about the market and pricing complicates investment decisions. Another issue arises from a unique feature of REEs. All naturally occuring REEs co-exist in the same orebody and are produced together when processing the ore. While the four elements widely used in clean energy technologies are poised to be in high demand, other elements such as cerium and lanthanum do not share the same positive outlook. If a company is to produce neodymium to meet rising demand, it also needs to deal with surplus cerium, the price of which is likely to remain subdued. This could weigh on aggregate profits from REE production, implying that higher prices for neodymium might not necessarily trigger new investment. There are also environmental concerns from REE processing, which need to be carefully managed.

Given the rapid rise in projected demand, production would need to increase both within and outside China, but these volumes need to be produced under higher environmental standards. New technologies could help unlock additional supply. For example, REEs could be recovered from the deposits of nuclear fuels. The US Department of Energy has funded several projects to develop commercially viable technologies to extract REEs from coal and coal by-product sources.

Approaches to ensure reliable mineral supply

IEA’s six pillars of a comprehensive approach to mineral security

While each country has different motivations and approaches to the issue of critical minerals, their experiences provide useful lessons for designing frameworks to ensure reliable mineral supplies. Past approaches have varied depending on whether the country is a producer or a consumer, but this distinction is increasingly becoming blurred as producer countries strive to build a domestic industry to produce clean energy equipment, and consumer countries seek to revitalise domestic production or secure overseas production assets. This suggests that an approach to ensuring reliable mineral supplies needs to be multi-faceted, covering a wide range of aspects from supply to demand to recycling.

Based on the IEA’s long-standing leadership in energy security, we identify six important pillars of a broad approach to minerals security, complementing countries’ existing initiatives.

Ensure adequate investment in diversified sources of new supply

- Strong signals from policy makers about the speed of energy transitions and the growth trajectories of key clean energy technologies are critical to bring forward timely investment in new supply.

- Governments can play a major role in creating conditions conducive to diversifed investment in the mineral supply chain, such as reinforcing national geological surveys, streamlining permitting procedures to shorten lead times, providing financing support to de-risk projects, and raising public awareness of the contribution that such projects play to the transformation of the energy sector.

Promote technology innovation at all points along the value chain

- Technology innovation can play a major role in alleviating strains on supply and reducing material costs. Costs associated with raw materials are likely to represent a larger portion of total investment costs for clean energy technologies in the future as other cost components continue to decline thanks to technology learning and economies of scale.

- Stepping up R&D efforts for technology innovation on both the demand and production sides can enable more efficient use of materials, allow material substitution and unlock sizeable new supplies, thereby bringing substantial environmental and security benefits.

Scaling up recycling

- Recycling relieves the pressure on primary supply requirements. The security benefits of recycling can be far greater for regions with wider deployment of clean energy technology due to greater economies of scale.

- Policies can play a pivotal role in preparing for rapid growth of waste volumes by incentivising recycling for products reaching the end of their operating lives, supporting efficient collection and sorting activities and funding R&D into new recycling technologies.

Enhancing supply chain resilience and market transparency

- Regular market assessments and periodic stress-tests, coupled with emergency response exercises (as with the IEA’s existing emergency response programmes), can help policy makers identify points of potential weakness, evaluate potential impacts and devise necessary actions.

- Strategic stockpiling can in some cases also help countries weather short-term supply disruptions. Such programmes need to be carefully designed, based on a detailed review of potential vulnerabilities.

- Establishing reliable price benchmarks will be a crucial step towards enhancing transparency and supporting market development, especially for minerals with smaller markets (e.g. lithium).

- Policy makers need to explore a range of measures to improve the resilience of supply chains for different minerals, develop response capabilities to potential supply disruptions and enhance market transparency.

Mainstreaming higher environmental and social standards

- Efforts to incentivise higher environmental and social performance can increase sustainably and responsibly produced volumes and lower the cost of sourcing them. If players with strong environmental and social performance are rewarded in the marketplace, it can lead to greater diversification among supply.

- Co-ordinated policy efforts will be needed: (i) to provide technical and political support to countries seeking to improve legal and regulatory practices; (ii) to incentivise producers to adopt more sustainable operational practices; and (iii) to ensure that companies across the supply chain undertake due diligence to identify, assess and mitigate these risks.

Strengthening international collaboration between producers and consumers

- An overarching international framework for dialogue and policy co ordination among producers and consumers can play a vital role, an area where the IEA’s energy security framework could usefully be leveraged. Such an initiative could include actions to (i) provide reliable and transparent data; (ii) conduct regular assessments of potential vulnerabilities across supply chains and potential collective responses; (iii) promote knowledge transfer and capacity building to spread sustainable and responsible development practices; and (iv) strengthen environmental and social performance standards to ensure a level playing field.

Focus on recycling

Scaling up recycling can bring considerable security and environmental benefits

In certain contexts, secondary markets for specific metals have developed in recent years even in the absence of policy support. This has occurred where market prices were high enough to encourage investment in recycling and a sizeable, readily available supply of waste stock existed. This is not currently the case for many minerals and metals that are vital for energy transitions. Barriers to further development of secondary supplies include competition from primary supply, information deficits and limited waste collection (Nicolli et al, 2012; Söderholm, 2020). A range of policy options can support the development of secondary supply markets and reduce many of the environmental and social impacts associated with mining.

In addition, it will be important for policy makers to address other potential externalities associated with secondary supplies. They include supporting the development of collection and sorting programmes and incentivising manufacturers to develop products that are easier to recycle.

Increasing collection and sorting rates is a crucial starting point to scale up recycling. Government policies can play a major role in facilitating waste collection, thereby ensuring a sufficiently large waste stream to justify infrastructure investment. Waste collection can also be encouraged by making the manufacturer responsible for the treatment or disposal of post-consumer products. This can also encourage manufacturers to reduce waste and to adopt product designs that facilitate recycling processes. Depending on the market and national/regional considerations, combinations of trading credits, subsidies and other policy instruments can successfully support regional secondary supply value chains that ultimately influence global markets.

The picture for battery recycling is set to change significantly from 2030 as an influx of spent batteries arrives

Although the volume of lithium-ion batteries available for recycling or reuse today is modest and largely dominated by batteries in waste electronic products, the fast-paced growth of EV sales and the demand for energy storage are poised to alter this situation significantly by the end of the decade. As the share of electric cars in the total car stock grows from today’s 1% to 18% in the STEPS and 50% in the SDS by 2040, an influx of spent batteries is expected to arrive in the market, and is likely to pose serious waste management challenges. For example, when all the electric cars sold in 2019 reach the end of their lifetime, this would result in 500 000 tonnes of unprocessed battery pack waste (Harper et al., 2019).

The amount of spent batteries from EV and storage applications is under 2 GWh today. The volume reaching the end of their first life rises modestly over the period to 2030 to the tune of 100 GWh, and grows rapidly thereafter to reach 450 GWh in the STEPS and over 1.3 TWh in the SDS by 2040. This represents over 20% of new battery requirements in that year.

Policy can play a pivotal role in preparing for the exponential growth in volumes of waste EV and storage batteries

Despite various technological and commercial challenges existing today, the projected surge in spent volumes suggests immense scope for recycling. Policy makers can help realise the potention through three specific actions: (i) facilitating the efficient collection and transport of spent batteries; (ii) fostering product design and labelling that help streamline the recycling process; and (iii) harmonising regulations on international movement of batteries.

The recycled mineral volumes are minimal in the 2020s, but they start to make larger contributions to the total supply from 2030 and become much more significant by 2040. In the SDS where the assumed collection rate increases gradually to 80% by 2040, recycled quantities of nickel, copper, cobalt and lithium in 2040 are around 500 kt, 350 kt, 100 kt and 60 kt respectively. By 2040 secondary production from recycled minerals accounts for up to 12% of total supply requirements for cobalt, around 7% for nickel, and 5% for lithium and copper. The projected contribution of reused batteries is relatively smaller, reaching only 1-2% of total supply requirements for each mineral in 2040.

Overall, the recycling of end-of-life lithium-ion batteries to recover the valuable minerals, and to a smaller extent their reuse as second-life batteries, can reduce combined primary supply requirements for these minerals by around 10%. Although this does not eliminate the need for continued investment in primary supply of minerals, the contributions from recycled minerals could be even more prominent in the total supply if effective recycling policies are adopted more widely across the globe, with larger benefits particularly for the regions with higher EV deployment.