Cite report

IEA (2020), World Energy Outlook 2020, IEA, Paris https://www.iea.org/reports/world-energy-outlook-2020, Licence: CC BY 4.0

Report options

An energy world in lockdown

How has Covid-19 changed the game?

The Covid-19 pandemic has introduced major new uncertainties for the energy sector and increased dramatically the range of pathways that it could follow. The key questions include the duration of the pandemic, the shape of the recovery, and whether energy and sustainability are built into the strategies adopted by governments to kick-start their economies.

The special circumstances of 2020 require a special approach in this World Energy Outlook. The usual long-term modelling horizons are maintained, but the focus is principally on the next ten years, exploring the impacts of the pandemic on the energy sector and the prospects for accelerated clean energy transitions.

Overall, we estimate that energy demand in 2020 is set to be 5% lower than in 2019. Since the most carbon-intensive fuels, coal and oil, are bearing the brunt of this demand reduction, and renewables are least affected, CO2 emissions are set to fall by nearly 7%. Capital investment in the energy sector is anticipated to fall by 18% in 2020, with the largest drop in spending on new oil and natural gas supply. This slump in investment is likely to have major repercussions for energy markets in the coming years, even though the economic downturn is also putting downward pressure on demand. The crisis is meanwhile provoking changes in the strategic orientation of companies and investors, as well as in consumer behaviour.

Change in renewables and nuclear power generation and fossil fuel demand by region, 2019-2020

OpenThere can be no single answer about where the energy world goes from here. This World Energy Outlook–2020 (WEO-2020) offers various scenarios, along with multiple sensitivity analyses and case studies, to explore the possible pathways.

New reported Covid-19 cases by region, January-September 2020

OpenThe Stated Policies Scenario (STEPS) assumes that significant risks to public health are brought under control over the course of 2021, allowing for a steady recovery in economic activity. This scenario incorporates our assessment of all today’s policy ambitions and targets, including the energy components of announced stimulus and recovery packages and the Nationally Determined Contributions under the Paris Agreement. Broad energy and climate objectives set out by countries, including net-zero targets for emissions, are incorporated in the STEPS to the extent that they are backed up by specific policies and measures.

The Delayed Recovery Scenario (DRS) retains the initial policy assumptions of the STEPS but takes a more pessimistic view on the health and economic outlook. In this scenario, a prolonged pandemic has deeper and longer lasting impacts on a range of economic, social and energy indicators than is the case in the STEPS; the global economy in 2040 is almost 10% smaller than in the STEPS.

The Sustainable Development Scenario (SDS) is based on the same economic and public health outlook as the STEPS, but it works backwards from shared long-term climate, clean air and energy access goals, examining what actions would be necessary to achieve those goals. The near-term detail is drawn from the recent International Energy Agency (IEA) Sustainable Recovery Plan, which boosts economies and employment while building cleaner and more resilient energy systems.

The Net Zero Emissions by 2050 case (NZE2050) supplements the SDS analysis. The SDS requires that many advanced economies reach net-zero emissions by 2050 at the latest. The NZE2050 includes the first detailed IEA modelling of what would be needed over the next ten years to put CO2 emissions on a pathway to net zero globally by 2050.

In this edition, the fuel price outlook in the STEPS and SDS is lower than in the World Energy Outlook-2019 because of the dampening effect of the crisis on demand and supply costs. However, although equilibrium prices are lower, the large drops in investment in 2020 increase the possibility of new price cycles and volatility.

Selected fossil fuel prices in 2019-2020

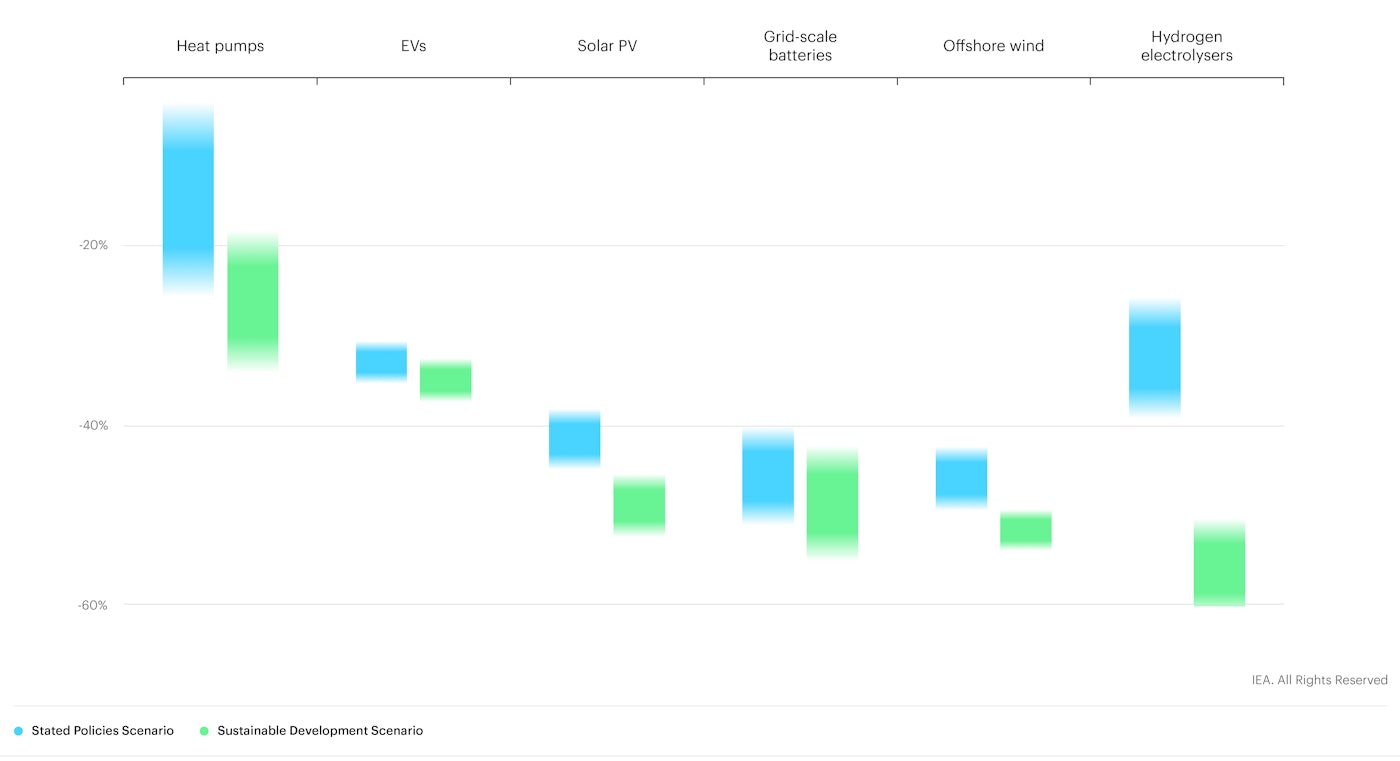

OpenThis Outlook incorporates a continuous process of technology improvement and learning. Its speed is linked to deployment, which therefore varies by scenario. Cost trends reinforce policy preferences for low-carbon energy options, especially in the rapid energy transition scenarios, where the speed at which new technologies are introduced is as fast as has ever been seen in the history of energy (IEA, 2020a).

Capital costs for selected energy technologies in 2040 relative to 2019

Open