Oil Market Report - March 2020

This report is part of Oil Market Report

About this report

Highlights

- Covid-19 (coronavirus) has spread beyond China and our 2020 base case global oil demand forecast is cut by 1.1 mb/d. For the first time since 2009, demand is expected to fall year-on-year, by 90 kb/d. In 1Q20, China’s demand falls by 1.8 mb/d y-o-y with global demand down 2.5 mb/d. We assume that oil demand returns to close to normal in 2H20. In this Report we provide a Low Case and a High Case detailing weaker and stronger outlooks, respectively.

- Global oil supply fell by 580 kb/d in February as production from Libya slowed to a trickle. At 100 mb/d, output was virtually flat on a year ago, with non-OPEC gains of 2.4 mb/d offsetting declines from OPEC. Robust non-OPEC supply gains of 2.1 mb/d in 2020 and a contraction in demand cut the call on OPEC crude to 27.3 mb/d. In 1Q20, the call is 25 mb/d, 3.5 mb/d below the group’s assumed output for the period.

- Global refining throughput in 2020 is expected to decline for the second consecutive year, falling below 2017 levels as demand for transport fuels plunges in the wake of the coronavirus. In 1Q20, refining intake has been revised down by 1.2 mb/d, primarily due to China, where February runs are estimated at 10.1 mb/d, down 2.7 mb/d y-o-y. February margins saw short-lived support from falling crude oil prices.

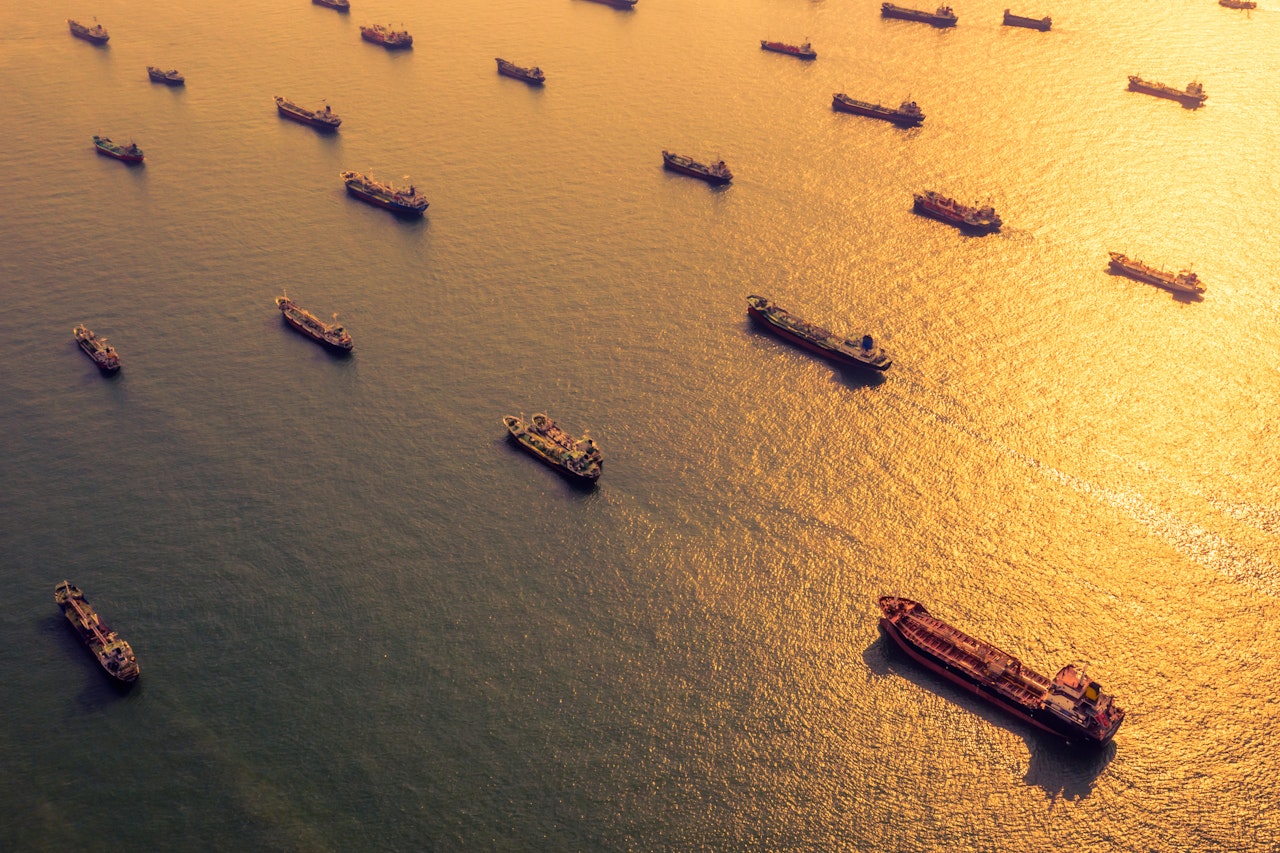

- OECD industry stocks rose by 27.8 mb to 2 930 mb in January as a build in product inventories more than offset counter-seasonal draws in crude stocks. Total oil stocks stood 2.9 mb above the five-year average and covered 63 days of forward demand. Short-term floating storage of crude oil built 1.9 mb in February to 80.2 mb, most of which is owned by Iran. Satellite data show a near 1 mb/d increase in Chinese stocks, reflecting slowing demand.

- ICE Brent fell below $46/bbl during 6 March, the lowest level since June 2017. As well as the negative impact on demand of the coronavirus, the outcome of the OPEC+ meeting was seen by traders as a bearish signal. In February and into March, Chinese run cuts pressured the price of crude from the Middle East and West Africa in particular. Travel restrictions and lower industrial activity due to the virus weighed on cracks for jet fuel, diesel and gasoil.

Highlights

- Covid-19 (coronavirus) has spread beyond China and our 2020 base case global oil demand forecast is cut by 1.1 mb/d. For the first time since 2009, demand is expected to fall year-on-year, by 90 kb/d. In 1Q20, China’s demand falls by 1.8 mb/d y-o-y with global demand down 2.5 mb/d. We assume that oil demand returns to close to normal in 2H20. In this Report we provide a Low Case and a High Case detailing weaker and stronger outlooks, respectively.

- Global oil supply fell by 580 kb/d in February as production from Libya slowed to a trickle. At 100 mb/d, output was virtually flat on a year ago, with non-OPEC gains of 2.4 mb/d offsetting declines from OPEC. Robust non-OPEC supply gains of 2.1 mb/d in 2020 and a contraction in demand cut the call on OPEC crude to 27.3 mb/d. In 1Q20, the call is 25 mb/d, 3.5 mb/d below the group’s assumed output for the period.

- Global refining throughput in 2020 is expected to decline for the second consecutive year, falling below 2017 levels as demand for transport fuels plunges in the wake of the coronavirus. In 1Q20, refining intake has been revised down by 1.2 mb/d, primarily due to China, where February runs are estimated at 10.1 mb/d, down 2.7 mb/d y-o-y. February margins saw short-lived support from falling crude oil prices.

- OECD industry stocks rose by 27.8 mb to 2 930 mb in January as a build in product inventories more than offset counter-seasonal draws in crude stocks. Total oil stocks stood 2.9 mb above the five-year average and covered 63 days of forward demand. Short-term floating storage of crude oil built 1.9 mb in February to 80.2 mb, most of which is owned by Iran. Satellite data show a near 1 mb/d increase in Chinese stocks, reflecting slowing demand.

- ICE Brent fell below $46/bbl during 6 March, the lowest level since June 2017. As well as the negative impact on demand of the coronavirus, the outcome of the OPEC+ meeting was seen by traders as a bearish signal. In February and into March, Chinese run cuts pressured the price of crude from the Middle East and West Africa in particular. Travel restrictions and lower industrial activity due to the virus weighed on cracks for jet fuel, diesel and gasoil.

Oil markets upended by demand and supply concerns

In the past few weeks, Covid-19 (coronavirus) has gone from being a Chinese health crisis to a global health emergency. While China has taken strong measures in response to the outbreak, the situation appears to be worsening around the world, with more than 60 countries reporting cases. The impact on the world economy is becoming more apparent, and growth estimates for this year are being downgraded. Earlier this month, the OECD lowered its global economic growth estimate for 2020 by 0.5% to 2.4%, a revision that is factored in to our latest projections.

While the situation remains fluid, we expect global oil demand to fall in 2020 – the first full-year decline in more than a decade – because of the deep contraction in China, which accounted for more than 80% of global oil demand growth in 2019, and major disruptions to travel and trade.

Containment measures have resulted in drastic reductions in international and domestic transportation around the world as countries respond to the rapid spread of the virus. Data are far from complete but, in the first quarter, the visible decline in transport, industrial and commercial activity points to a massive drop in global oil demand of 2.5 mb/d compared with the first quarter of last year. This includes an estimated annual decline of 4.2 mb/d in February, of which 3.6 mb/d was in China.

The immediate outlook for the oil market will ultimately depend on how quickly governments move to contain the coronavirus outbreak, how successful their efforts are, and what lingering impact the global health crisis has on economic activity. At this stage, high uncertainty over the course of the outbreak has led us to propose alternatives to our base case – a more pessimistic one in which global measures are less successful in containing the virus; and an optimistic case in which the virus is contained quickly.

In our base case, the outbreak is brought under control in China by the end of the first quarter but spreads across many other countries beyond Iran, Korea, Japan, Singapore, the United States and Europe. Containment measures imposed in North America, Europe and elsewhere are expected to have a smaller impact on oil demand than those in China. However, demand from the aviation sector will continue to suffer from the contraction in global air travel.

In the first quarter, China suffers the most with a year-on-year drop in oil demand of 1.8 mb/d as factories shut down and large-scale confinement measures curb transportation. In the second quarter, as the situation in China improves, demand deteriorates in some other large economies, such as Japan and Europe. Overall, global oil demand in the second quarter is only slightly lower than a year ago. As we move through the second half of the year, demand picks up, growing by 1.1 mb/d compared with the second half of 2019. For 2020 as a whole, the magnitude of the drop in the first half leads to a decline in global oil demand of around 90,000 barrels per day, the first annual fall since 2009.

Our pessimistic low case assumes that countries already affected by the virus recover more slowly while the epidemic spreads further in Europe, Asia, and beyond. It takes longer to control the propagation of the virus, and the contraction in Chinese oil demand eases more slowly in March. European demand remains subdued in the third quarter, and demand in the United States grows at a slower pace. In this pessimistic case, global oil demand could decline by 730,000 barrels per day in 2020.

In a more optimistic high case, we assume that the situation comes swiftly under control in China and the most serious contagion remains limited to a few countries, with no serious impact in most of Europe and North America. In this context, governments do not need to take strong containment measures and use of transport remains closer to normal. In this case, global oil demand could grow by 480,000 barrels per day in 2020.

Against a background of collapsing global oil demand, OPEC+ producers met on 6 March to review the market situation. The group’s current 2.1 mb/d of production cuts are due to expire at the end of the month. A statement issued at the end of the meeting made no mention of supply restraint, saying only that further consultations will take place. The implication, therefore, is that the OPEC+ countries will be free to exercise their commercial judgement when assessing future levels of production.

With extraordinary uncertainty clouding the immediate outlook for the global oil market both on the demand and supply sides, and of course for prices which ended the week $5/bbl (Brent) lower than on the eve of the OPEC+ meeting, the IEA will continue to monitor the situation closely.

Oil markets upended by demand and supply concerns

In the past few weeks, Covid-19 (coronavirus) has gone from being a Chinese health crisis to a global health emergency. While China has taken strong measures in response to the outbreak, the situation appears to be worsening around the world, with more than 60 countries reporting cases. The impact on the world economy is becoming more apparent, and growth estimates for this year are being downgraded. Earlier this month, the OECD lowered its global economic growth estimate for 2020 by 0.5% to 2.4%, a revision that is factored in to our latest projections.

While the situation remains fluid, we expect global oil demand to fall in 2020 – the first full-year decline in more than a decade – because of the deep contraction in China, which accounted for more than 80% of global oil demand growth in 2019, and major disruptions to travel and trade.

Containment measures have resulted in drastic reductions in international and domestic transportation around the world as countries respond to the rapid spread of the virus. Data are far from complete but, in the first quarter, the visible decline in transport, industrial and commercial activity points to a massive drop in global oil demand of 2.5 mb/d compared with the first quarter of last year. This includes an estimated annual decline of 4.2 mb/d in February, of which 3.6 mb/d was in China.

The immediate outlook for the oil market will ultimately depend on how quickly governments move to contain the coronavirus outbreak, how successful their efforts are, and what lingering impact the global health crisis has on economic activity. At this stage, high uncertainty over the course of the outbreak has led us to propose alternatives to our base case – a more pessimistic one in which global measures are less successful in containing the virus; and an optimistic case in which the virus is contained quickly.

In our base case, the outbreak is brought under control in China by the end of the first quarter but spreads across many other countries beyond Iran, Korea, Japan, Singapore, the United States and Europe. Containment measures imposed in North America, Europe and elsewhere are expected to have a smaller impact on oil demand than those in China. However, demand from the aviation sector will continue to suffer from the contraction in global air travel.

In the first quarter, China suffers the most with a year-on-year drop in oil demand of 1.8 mb/d as factories shut down and large-scale confinement measures curb transportation. In the second quarter, as the situation in China improves, demand deteriorates in some other large economies, such as Japan and Europe. Overall, global oil demand in the second quarter is only slightly lower than a year ago. As we move through the second half of the year, demand picks up, growing by 1.1 mb/d compared with the second half of 2019. For 2020 as a whole, the magnitude of the drop in the first half leads to a decline in global oil demand of around 90,000 barrels per day, the first annual fall since 2009.

Our pessimistic low case assumes that countries already affected by the virus recover more slowly while the epidemic spreads further in Europe, Asia, and beyond. It takes longer to control the propagation of the virus, and the contraction in Chinese oil demand eases more slowly in March. European demand remains subdued in the third quarter, and demand in the United States grows at a slower pace. In this pessimistic case, global oil demand could decline by 730,000 barrels per day in 2020.

In a more optimistic high case, we assume that the situation comes swiftly under control in China and the most serious contagion remains limited to a few countries, with no serious impact in most of Europe and North America. In this context, governments do not need to take strong containment measures and use of transport remains closer to normal. In this case, global oil demand could grow by 480,000 barrels per day in 2020.

Against a background of collapsing global oil demand, OPEC+ producers met on 6 March to review the market situation. The group’s current 2.1 mb/d of production cuts are due to expire at the end of the month. A statement issued at the end of the meeting made no mention of supply restraint, saying only that further consultations will take place. The implication, therefore, is that the OPEC+ countries will be free to exercise their commercial judgement when assessing future levels of production.

With extraordinary uncertainty clouding the immediate outlook for the global oil market both on the demand and supply sides, and of course for prices which ended the week $5/bbl (Brent) lower than on the eve of the OPEC+ meeting, the IEA will continue to monitor the situation closely.

Subscription successful

Thank you for subscribing. You can unsubscribe at any time by clicking the link at the bottom of any IEA newsletter.